Piotroski F-Score is a value investing strategy, which

was published by Joseph D Piotroski in 2002. The exact title of the paper is “Value

investing: The use of historical financial statement information to separate winners

from losers.

For a better understanding of the strategy and its exact

economical intuitions, I strongly recommend you to read the paper by following

the link - Piotroski F-Score

By introducing this strategy to my readers I only mean

that you can use this as a tool to identify some good stocks which are

neglected by the market. This article doesn’t give you a strategy to analyze the whole universe of stocks. Researchers found this strategy works really fine and

had given an annualized return of 23% from 1976-1996. It is really huge.

What

is value investing?

Value investing generally pick up stocks which were neglected by

the market, after sometime market realizes these are good stocks and then the price goes up.

What

Piotroski actually did?

Piotroski F-Score strategy giving an algorithm to identify the subset of stocks within the value stocks which is going to outperform the

others.

Where

I can apply Piotroski F-Score?

This strategy applies to the stocks having a high book to market value. The research found that financially strong high BM stocks give an increased return of 7.5%

annually than buying all high BM stocks.

Algorithm

Piotroski F-Score has three measures each having components,

total of nine components.

1. Profitability

measures

2. Capital

structure measures

3. Operational

efficiency measures

Each measure are further divided,

1.

Profitability

measures

i.

Return

on Assets (ROA)

· Net

income before extra-ordinary items scaled by the beginning of the year total

assets.

· If

the firm's ROA is positive, then indicator variable F_ROA

is equal to 1. Zero otherwise.

Note: - Extraordinary item means, the items which

are not included in their primary business (If a pharma company sells their

land, it is an extraordinary item. Because their primary products are medicine).

Note: - Beginning of

the year’s asset is obtained from the last year’s annual report.

ii.

Cash

flow from operations(CFO)

· It

is defined as the cash flow from operations scaled by beginning year’s total

assets.

· If

CFO is positive F_CFO is equal to

one otherwise zero.

iii.

ΔROA

· It

is the current year's ROA less the previous year’s ROA.

ΔROA = Current year’s

ROA – Previous years ROA

· If

ROA is positive then, F_ΔROA is 1. Zero otherwise.

iv.

Accrual

· It

is defined as the current year’s net income before extraordinary items less

cash flow from operations, scaled by the beginning of the year total assets.

· If

CFO greater than ROA, i.e. Accrual negative implies F_ACCRUAL

equals one. Zero otherwise.

2.

Capital

structure measures

v.

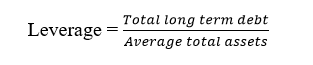

ΔLEVER

· It

is the difference in the value of the ratio of total long term debt to average

total for the current year and the previous year.

· ΔLEVER=

Current year’s leverage – Previous year’s leverage

· F_LEVER

equals one if ΔLEVER is negative, otherwise zero.

vi.

ΔLIQUID

· It

is the historical change in the firm’s current ratio between the current year

and the prior year. Where the current ratio is the ratio of current assets to

current liabilities.

·

F_LIQUID is

one if ΔLIQUID is positive, zero otherwise.

vii.

EQ_OFFER

· It is an indicator variable

whose value is equal to one of the firm did not issue common equity in the year

preceding portfolio formation, zero otherwise.

3.

Operational

efficiency measures

viii.

ΔMARGIN

· It is the firm’s

current gross margin ratio (gross margin scaled by total sales) less the prior

year’s gross margin ratio.

·

F_MARGIN equals

one if ΔMARGIN is positive, otherwise zero.

ix.

ΔTURN

· It

is the firm’s current year’s asset turnover ratio (total sales scaled by

beginning of the year’s total assets) less than the prior year’s asset turnover.

· F_ΔTURN equals one if ΔTURN is positive, zero otherwise.

Composite

score

F-Score is the sum of the individual binary signals.

Given the nine underlying signals, F-Score can range from 0 to

9. Where a low F-Score represents a firm with very few good signals and vice

versa.

So you can long the stocks having high F-Score.

When

to trade?

As early as the financial statements are publically available.

Key

point: - In

actual case it is very risky to hold a portfolio having stocks of high book to

market value. So I am suggesting you adopt this method to analyze high BM stocks

and to find potential multi-baggers from this universe of stocks. For this you

have to invest time in this strategy and your skills will give you some

potential stocks.

Use Excel to analyze data and also use screeners like tickertape.in, screener.in to find out high BM stocks.

2 Comments

This comment has been removed by the author.

ReplyDeleteIt was great reading your blog.

ReplyDeleteDo share your views based on Fundamental Analysis of Equity Shares.

Each comment is motivation. Please share your views about the post.