In an uptrend, if the price opens above the previous days high and the price never falls below previous days high through the entire day, which gives a gap. The reverse happens in a downtrend.

Four Types of Gaps

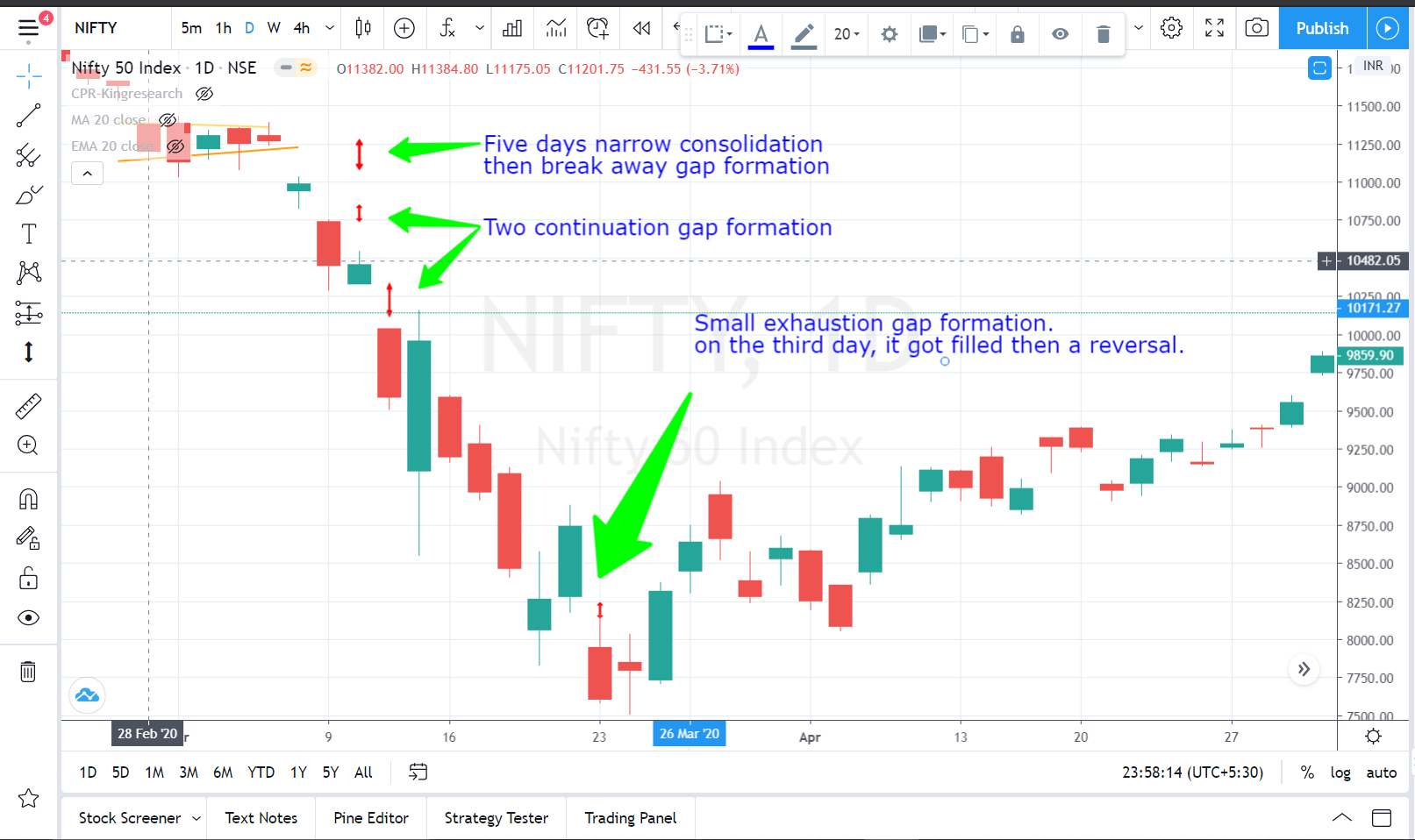

- Breakaway Gap

- These type of gaps occurs at the end of an important price pattern. It forms by the breaking of a strong resistance/support signaling a strong down/uptrend.

- Formed with a huge volume.

- These gaps are not filled.

- If the price falls into these gaps signaling weakness in the trend.

- In the correction stage upside gap act as support.

- The Runaway or Measuring Gap

- These gaps are formed somewhere around the middle of a trend (that's why called measuring gap). Which shows the strength of that subsequent trend.

- More than one gap may possible.

- These gaps are often not filled.

- Act as support in correction stage.

- The Exhaustion Gap

- Forms at the end of a trend.

- The gap will be filled in a week.

- In some cases after the formation of an Exhaustion Gap, the price gets consolidated and another gap is formed in the opposite direction leaves an island-like formation is called the Island Reversal.

- Common Gap

- It is simply an area where no trading has taken place. It does not have much significance.

- These gaps get always filled.

It is very important in technical analysis to interpret the significance of gaps. You can take more probable trades by analyzing these gaps. Remember TA more relies on probability.

I hope you have enjoyed the concept that I have mentioned above if you have liked please fill your valuable comments in the comment box and follow my channel to get updated on each content.

Thank you.

2 Comments

Informative article🤝🤝

ReplyDeleteWow... I learned in some paid course about the gap theory but never taught me about different types of gaps. Any how thank you for the content.

ReplyDeleteEach comment is motivation. Please share your views about the post.